reverse tax calculator uk

This calculator is useful if you want to calculate VAT backwards. NB The introduction has been.

Reverse Value Added tax calculator UK 2019.

. For example 120 is the figure 12 100 which is now the pricefigure excluding VAT. The reverse sales tax calculator exactly as you see it above is 100 free for you to use. It has also been updated for the VAT reverse charge requirements which apply from 1st March 2021.

Value Added tax calculator UK 2019. Reverse Calculate Income Tax - Calculate Net to Gross - Find out how much you need to earn before tax to take home an income you enter - for PAYE CIS and Self Employed. UK customer to account for the output tax adjustment of X to HMRC.

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay. Using the calculator you can calculate the gross pay before tax for a required level of take home pay. Click to go back to top.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. If you want to remove VAT from a figure to make a reverse VAT calculation to divide the amount by 100 VAT percentage and then multiply by 100. If this is difficult for you use.

Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Removing VAT is not 080 try the VAT Calculator to see Calculate the VAT content of a number which is inclusive of VAT. The net to gross salary calculator requests the net pay required and then computes the gross pay computing.

Reverse Value Added tax calculator UK 2020. Ad Xero software lets you connect with your bank collaborate with your accountant staff. Here is how the total is calculated before VAT.

The Reverse Tax Calculator is part of the. Amount with VAT 1 VAT rate 100 Amount without VAT. It includes the net to gross tax calculator.

Our CIS Tax Deduction Calculator can assist contractors in calculating the correct deductions to make. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions. Reversing Removing VAT Formula.

Rerverse calculator of the VAT in UK 20 5 or 0 free reverse calculator of VAT in United Kingdom in 2022. In short work backwards from the money you want to take home to the Gross salary required to give you that take home pay. Reverse Calculate Income Tax - Calculate Net to Gross - Find out how much you need to earn before tax to take home an income you enter - for PAYE CIS and Self Employed.

Reverse VAT Calculator UK 2021 A simple reverse VAT calculator Simply enter the GROSS figure in the top box and the NET figure will appear in the box below. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. Cash accounting scheme.

You can use tax rates from 2013 to 2002 and specify either weekly or annual net after Tax earnings. Formulas to calculate the United Kingdom VAT. We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

Amount without sales tax VAT rate VAT amount. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator.

Calculate VAT from the total price of a product or service which includes VAT. Take 20 off a price or any number. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

This calculation is used on a regular basis by Personal Injury and Family Law lawyers. This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered. Divide the pricefigure by 1.

You may be asking I have the vat amount what is the NET. You may reclaim the input tax on your reverse charge purchases subject to the normal VAT rules. Click the Customize button above to learn more.

Online accounting software with all the time-saving tools you need to grow your business. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. It will work for all types of subcontractors Gross 0 CIS Deduction Net 20 CIS Deduction and Unregistered 30 CIS Deduction.

This is based on Income Tax National Insurance. Now you know the amount exclusive of VAT Net amount. For example the UK VAT rate is 20 which means you would do pricefigure 12.

Calculate the VAT element of a price. Tax Calculator 2022-2023.

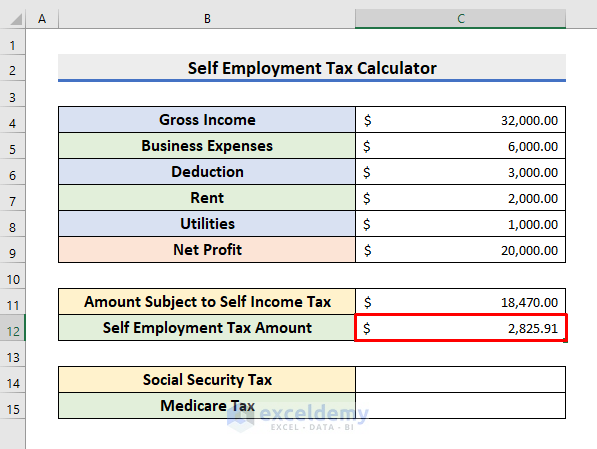

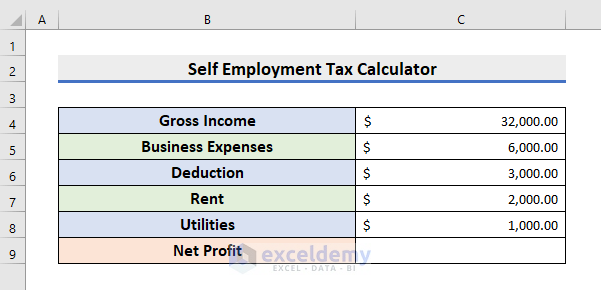

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Ultimate Corporation Tax Calculator 2022

Calculate Fixed Amount Before Tax Calculation 1612662 Drupal Org

Uk Tax Calculators Amazon Com Appstore For Android

Uk Tax Calculators Amazon Com Appstore For Android

Dutch Vat Calculator Vatcalculator Eu

Uk Tax Calculators Amazon Com Appstore For Android

Personal Tax Uk Tax Calculators

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

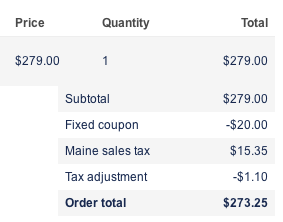

Setting Up Taxes In Woocommerce Woocommerce

![]()

Small Business Tax Planner Uk Tax Calculators

Benefit In Kind Tax Calculator Uk Tax Calculators

How To Calculate Income Tax In Excel

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps